- Have any questions?

- 501-798-0004

- lisa@lisagdouglas.com

- 2300 Main, North Little Rock, AR 72114

Social Security paperwork is difficult

Lisa Douglas, RN|Lawyer

![[tag] for Social Security Lisa Douglas](https://disabilityattorney.lisagdouglas.com/images/home_lawyer_about.png)

I am a health care professional and an social security disability attorney Little Rock. My business is uniquely ready to represent disability benefits, medical, healthcare, and fight the social security administration for you. Filing for social security can be a long-term and sophisticated course of action. I assists you to cut through the bureaucracy, and take care of the government on your behalf.

Social Security Disability Attorney Little Rock AR

I may be the Little Rock social security attorney for you. If you can answer yes to the following questions.

Work

Are you not able to perform the job 8 hrs on a daily basis, 5 days every week, due to your disabilities?

Disabling

Is your illness crippling?

Previous Work

Are you struggling to carry out the job which you formerly did or perform any other occupation?

Treatment

Have you been given treatment your healthcare professional prescribed and then followed your medical doctor's guidelines.

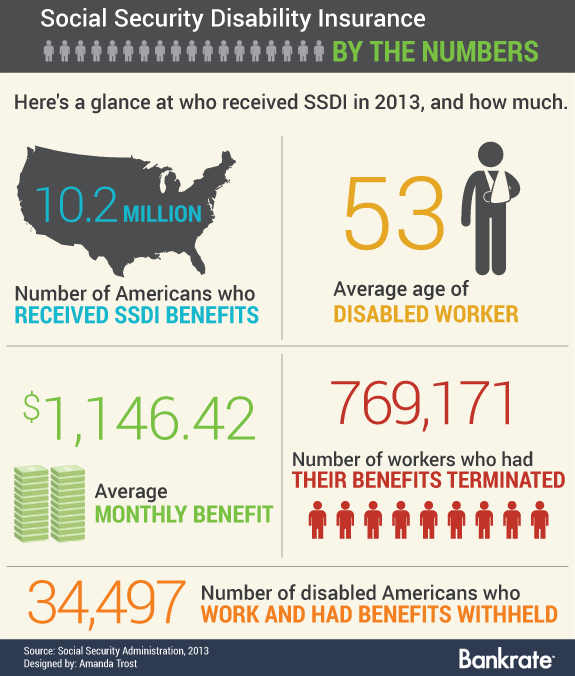

How the Social Security Administration Pays Disability Benefits

1. the Social Security Disability Insurance program

1. the Social Security Disability Insurance program

2. Supplemental Security Income (SSI) program.

You should apply for either program as soon as you become disabled. Supplemental Security Income (SSI) Program The Social Security Administration manages the SSI program. Even though Social Security manages the program, SSI is not paid for by Social Security taxes. SSI is paid for by U.S. Treasury general funds, not the Social Security trust funds. SSI makes monthly payments to people who have low income and few resources and are: Age 65 or older; Blind; or Disabled.

Whether you can get SSI depends on your income and resources (the things you own). Social Security Disability Insurance Program Social Security pays benefits to people who cannot work because they have a medical condition that is expected to last at least one year or result in death. Federal law requires this very strict definition of disability. While some programs give money to people with partial disability or short-term disability, Social Security does not

Definition of Disability: An individual under age 18 is “disabled” if he or she has a medically determinable physical or mental impairment, which:

1. Results in marked and severe functional limitations; and

2. Can be expected to result in death; or

3. Has lasted or can be expected to last for a continuous period of not less than 12 months.

How to apply for social security benefits.

You can apply for social security benefits by phone, online or in person. We can submit your application online for you. Let us deal with the government and you just take care of your health. Of the millions of applications received by the Social Security Administration (SSA) each year, only30% are approved at the initial stage of the application process. What happens to the remaining 70 percent? If the claimant wishes to move forward in order to receive Social Security Disability benefits, they must appeal the denial decision that was made during the initial application stage of the Social Security Disability application process.

Thefirst step in the Social Security Disability claim process is to file an application for disability benefits. For this initial application stage you will submit your application to the SSA along with all of your medical evidence and any other supporting documentation. It can take between 90 to 120 days to complete this stage of the disability claims process. And remember only 30 percent of Social Security Disability applications will be approved at this stage of the process.

Receive your FREE, no obligation Evaluation. Fill out the form to your right. Let us deal with the government, you just take care of your health.

How Work Affects Your Social Security Benefits.

Income is indisputably a crucial element to thoroughly consider when planning for your retirement. The local social security administration has stipulated guidelines to allow people to continue working even after retirement. Nonetheless,some of these aspects can affect your social security benefits. Thus, consult a social security attorney to help you understand and navigate these rules to ensure that you still receive the maximum benefits.

Working After or Before Full Retirement Age (FRA)

The full retirement age is between 65-67 years, depending on the year you were born. If you wait to attain your FRA to claim your benefits and continue working, you will receive your full social security amount regardless of how much you earn. However, if you claim your social security before reaching your FRA, you will lose one dollar in benefits for every two dollars earned over the $16,920 limit. The social security retirement earnings test calculator can help you to compute how your income will affect your benefit amount.

Recouping benefit reductions

Working between 62 and your FRA won’t diminish your lifetime benefits value. You’ll be contributing to your social security kitty and the money will be added to your retirement funds. Moreover, Social security administration will recalculate your benefits upon reaching the FRA and increase them to cover for the months they were withheld.

The income tax factor

Under the current tax legislation, all your benefits are tax-free, including your interests, pensions, government benefits, annuities, investment earnings, and capital gains as income. However, if have other sources of income, 85% of your social security benefits can be taxed. Social security administration considers wages and self-employment earnings as sources of income.

Work expenses

The social security administration understands that there are extra expenses incurred while working. Some of these expenses can include Impairment Related Work Expenses (IRWEs) and Blind Work Expenses (BWEs). These expenses can be used to figure out your countable earned income and can help keep your benefit amount higher

Need help? Call us today!

The law that governs the aspect of social security benefits can be complex and very confusing, and hence requires careful review. Attorneys at Lisa Douglas law firm thrive in offering the best legal representation whether you are applying your benefits for the first time or appealing a preceding denial. We have a wealth of litigation experience, and we will help you prepare, present, and receive your social security benefits claim. To learn more about how working might affect your social security benefits, call us 501-798-0004 today!